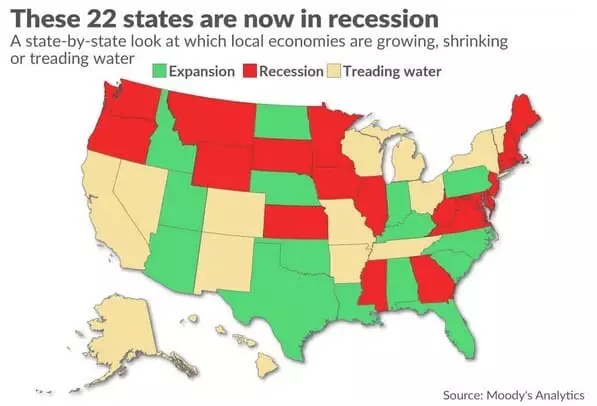

WAFD Exits Residential Mortgages, Citing Regulatory Burden and CRA Compliance Challenges

WAFD Bank has announced its decision to exit the residential mortgage market, citing a confluence of factors including the current economic climate, the potential for increased loan defaults, and notably, the increasing regulatory burden associated with mortgage lending. This move marks a significan

Owner Carry in Portland, Oregon: A Creative Path to Homeownership

Owner Carry in Portland, Oregon: A Creative Path to Homeownership The Portland, Oregon real estate market is known for its competitive landscape and high demand. But what if there was a way to buy your dream home, condo, townhome, floating home, multi-family property, or even commercial property wi

Oregon's Supercharged Savings Plan for First-Time Homebuyers

Buying your first home in Oregon just got easier! Starting in 2025, the state is giving future homeowners a powerful boost with an expanded First-time Home Buyer Savings Account (FTHBSA) program. This means you can save on taxes while saving for your dream home. Here's the lowdown: What is it? The F

Categories

Recent Posts