Buying a Business in Portland: A Comprehensive Guide

Thinking of buying a business in Portland, Oregon? It's an exciting opportunity, but navigating the process can feel overwhelming. This guide provides a roadmap to successful acquisition, outlining key steps and offering valuable insights to help you make informed decisions.

Understanding the Portland Market

Analyzing Market Trends

When considering businesses for sale in Portland, understanding market trends is crucial. Knowing which industries are thriving and identifying consumer behaviors can significantly impact your success. Here are some key points to consider:

- Sales Data: Review recent sales data to understand which sectors are performing well in the Portland area.

- Booming Industries: Identify industries with sustained growth in Portland, such as technology, healthcare, craft brewing, outdoor recreation, or niche markets like sustainable products and services.

- Consumer Behavior: Analyze Portland's unique consumer spending habits, focusing on shifts toward experiences, local products, or innovative offerings.

Working with knowledgeable professionals, like Portland business brokers, ensures you stay informed about local market dynamics and opportunities.

Identifying Key Industries in Portland

Investing in the right industry is crucial. Focus on sectors with strong growth potential and long-term stability in the Portland market. Industries such as technology, healthcare, food and beverage (especially craft beer and coffee), and outdoor recreation often present excellent opportunities. Don't overlook niche markets, which can be surprisingly profitable with the right approach.

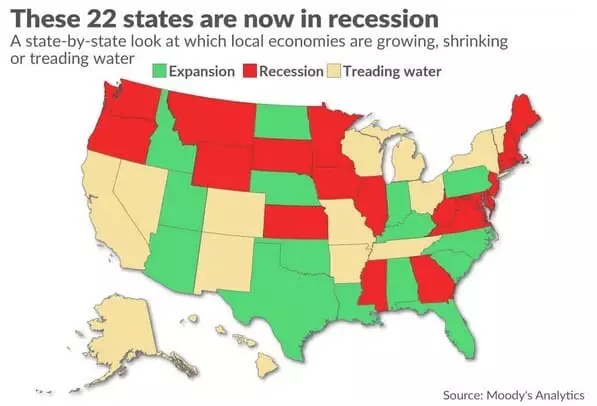

Evaluating Economic Factors

Economic conditions significantly impact business opportunities. Here’s how to stay ahead:

- Monitor interest rates and financing conditions.

- Assess the local economic climate in Portland, including population growth and consumer spending.

- Understand the competitive landscape to evaluate market saturation.

Understanding these factors helps position you for success when exploring businesses for sale in Portland.

Researching Potential Business Opportunities in Portland

Utilizing Online Platforms

Online platforms provide a comprehensive starting point for finding businesses for sale in Portland. Listings allow you to compare options, assess pricing, and identify potential opportunities. However, ensure you conduct thorough due diligence to verify accuracy.

Networking with Local Brokers

Connecting with local Portland business brokers can streamline your search. Brokers provide valuable insights, have access to off-market opportunities, and guide you through the purchasing process, saving time and effort.

Attending Industry Events in Portland

Industry events are invaluable for networking and discovering opportunities. Attend trade shows or local business meetups in Portland to connect with industry professionals, learn about trends, and potentially find the perfect business.

Assessing the Value of a Business

Understanding Financial Statements

Before purchasing a business, it’s essential to analyze its financial health. Focus on key documents:

- Profit and Loss Statements: Assess revenue and expenses to determine profitability.

- Balance Sheets: Review assets and liabilities for a clear financial picture.

- Cash Flow Statements: Evaluate the business’s ability to manage day-to-day operations.

Evaluating Assets and Liabilities

Understanding what a business owns (assets) and owes (liabilities) provides a clearer sense of its net worth. Key considerations include:

- Real estate, equipment, and inventory.

- Outstanding debts and obligations.

Subtracting liabilities from assets gives a realistic valuation of the business.

Considering Future Growth Potential

Examine the business’s scalability by evaluating market trends, competitive advantages, and areas for improvement. Identifying untapped opportunities can significantly increase the business’s value over time.

Negotiating the Purchase of a Business

Preparing for Negotiations

Preparation is vital for successful negotiations. Key steps include:

- Researching the business’s history, financials, and market position.

- Setting a clear budget, including flexibility for adjustments.

- Consulting Portland business brokers for guidance on negotiation tactics.

Understanding Legal Considerations

Legal due diligence is crucial to protect your investment. Key elements include:

- Drafting a Letter of Intent outlining initial terms.

- Reviewing contracts thoroughly to ensure clarity and fairness.

- Consulting legal professionals to navigate complexities.

Finalizing the Deal

Finalizing a business purchase involves agreeing on terms, securing financing, and signing a sales agreement. Ensure all documentation is in order and reviewed by professionals before closing.

Transitioning Ownership Smoothly

Communicating with Employees

Transparent communication with employees fosters trust and eases the transition. Introduce yourself, outline your vision, and address any immediate concerns to maintain morale.

Maintaining Customer Relationships

Customers are integral to a business’s success. Reach out to introduce yourself, emphasize continuity in service quality, and solicit feedback to strengthen relationships.

Implementing New Strategies

While new ownership often brings changes, proceed cautiously. Focus on gradual improvements rather than sweeping changes to avoid disrupting operations.

Leveraging Professional Assistance

Hiring a Business Broker

Business brokers are invaluable allies when buying a business. They provide market insights, handle complex negotiations, and ensure the process runs smoothly.

Consulting with Legal Experts

Legal experts ensure contracts and agreements are fair and comprehensive. They help safeguard your interests and ensure compliance with local regulations.

Working with Financial Advisors

Financial advisors assess the viability of your purchase, helping you navigate financing options and long-term planning to ensure financial stability.

Exploring Financing Options for Your Purchase

Understanding Different Loan Types

Explore various financing options, including:

- Traditional Bank Loans: Reliable but may require strong credit and collateral.

- SBA Loans: Government-backed loans with favorable terms.

- Online Lenders: Faster approval processes but may have higher interest rates.

Considering Investor Partnerships

Equity investors or angel investors can provide funding in exchange for ownership stakes. Venture capitalists may also invest in scalable businesses with high growth potential.

Evaluating Personal Financial Readiness

Assess your savings, credit score, and risk tolerance to determine your financial readiness. A thorough self-assessment ensures you’re prepared for the investment.

FAQs about Buying a Business in Portland

Q: What due diligence should I do before buying a business?

A: Due diligence is crucial. Investigate the business's financials, legal standing, operations, customer base, and employee situation. Analyze financial statements, review contracts, verify licenses, assess the competitive landscape, and understand the business model. Engage professionals like accountants and lawyers for assistance.

Q: Can I get financing to buy a business in Portland?

A: Possibly, but it depends on your financial situation, the business's financials, the lender's requirements, and the type of business. Explore options like SBA loans, conventional bank loans, seller financing, and alternative lenders. Prepare a strong business plan, maintain a good credit score, and provide a substantial down payment.

Q: What are the advantages of buying an existing business versus starting from scratch in Portland?

A: Buying an existing business offers an established foundation, potentially faster profitability, reduced startup costs, existing employees and systems, brand recognition, and easier access to financing. However, it may also involve a higher initial investment and potential inherited problems.

Q: How do business owners in Portland determine their asking price when selling?

A: Sellers often use a combination of valuation methods (income approach, market approach, asset-based approach), considering factors like financial performance, market conditions, and emotional attachment. The asking price is a starting point for negotiation.

Q: Is it true that most businesses for sale in Portland are unprofitable?

A: No, many profitable businesses are sold for various reasons like retirement, relocation, or new opportunities. Analyze financial statements, assess market position, inquire about the seller's motivation, and conduct thorough due diligence to identify profitable businesses.

Wrapping It Up

Finding the right local business to buy in Portland takes time, research, and professional guidance. By understanding market trends, assessing opportunities thoroughly, and leveraging expert assistance, you can identify a business that aligns with your goals. Take the leap and start your journey toward business ownership in Portland with confidence!

Categories

Recent Posts