Portland's Commercial Real Estate Market: A Data-Driven Overview

Portland, Oregon, is a city known for its progressive values, vibrant culture, and stunning natural beauty. It also boasts a dynamic and evolving commercial real estate market, offering a compelling opportunity for investors and businesses. Let's dive into the data and explore the key sectors shaping Portland's commercial real estate landscape.

Portland: A Thriving City

Before we delve into the specifics of commercial real estate, it's important to understand the context. Portland boasts a diverse economy, a growing population, and a strategic location in the Pacific Northwest.

- Population: The Portland-Vancouver-Hillsboro metro area has a population of over 2.5 million, with a nearly 22% increase since 2010.

- Economy: The Greater Portland area's total Gross Domestic Product is over $204 billion, demonstrating 31% growth in the past ten years. Key industries include technology (the "Silicon Forest"), manufacturing, healthcare, and green energy.

- Job Market: Portland has a 3.8% unemployment rate (as of May 2024) and boasts major employers like Providence Health & Services, Intel, Oregon Health & Science University, Nike, and Legacy Health.

Key Commercial Real Estate Sectors

-

Industrial:

- Market Overview (CBRE Portland Industrial Figures Report Q2 2024):

- Inventory: 221,815,348 SF

- Vacancy rate: 5.1%

- Under construction: 3,161,244 SF

- Net absorption: -1,610,452 SF (YTD)

- Key Trends: The industrial market is experiencing consistent demand, particularly for warehousing and logistics space. While financing challenges and increased supply have put some pressure on the market, prime spaces with interstate access and ample clearance heights remain highly sought after.

- Market Overview (CBRE Portland Industrial Figures Report Q2 2024):

SEARCH INDUSTRIAL PROPERTIES FOR SALE (or CONTACT US FOR A FULL LIST)

-

Office:

- Market Overview (Colliers Portland Metro Office Market Report Q2 2024):

- Inventory: 68,396,269 SF

- Vacancy rate: 23.4%

- Net absorption: -1,535,194 SF (YTD)

- Under construction: 368,347 SF

- Key Trends: The office market is showing signs of recovery, with key lease transactions and decreased returned space. However, high construction costs and tenant leverage continue to pose challenges for landlords.

- Market Overview (Colliers Portland Metro Office Market Report Q2 2024):

SEARCH OFFICES FOR SALE (or CONTACT US FOR A FULL LIST)

-

Retail:

- Market Overview (Colliers Portland Metro Retail Center Market Report Q1 2024):

- Inventory: 55,325,547 SF

- Vacancy rate: 5.7%

- Under construction: 151,180 SF

- Net absorption: 72,328 SF (Q1 2024)

- Key Trends: Robust suburban leasing activity is a highlight, particularly in Clark County/Vancouver, WA. Cost efficiency is driving a trend towards second-generation big box spaces.

- Market Overview (Colliers Portland Metro Retail Center Market Report Q1 2024):

SEARCH RETAIL PROPERTIES FOR SALE (or CONTACT US FOR A FULL LIST)

-

Multifamily:

- Market Overview (Colliers Portland Metro Multifamily Market Report Q1 2024):

- Total housing units: 1,065,476

- Multi-unit inventory: 237,567 units

- Vacancy rate: 6.2%

- Average effective rent: $1,714

- Net absorption: 1,301 units (Q1 2024)

- Under construction: 8,250 units

- Key Trends: Strong demand is leading to high absorption rates, but downward pressure on rents persists. The market shows signs of stabilizing, with potential for future rent growth and increased occupancy rates.

- Market Overview (Colliers Portland Metro Multifamily Market Report Q1 2024):

SEARCH RETAIL MULTI-FAMILY HOMES FOR SALE (or CONTACT US FOR A FULL LIST)

Investment Considerations in Portland

Portland's diverse commercial real estate market presents a range of investment opportunities. However, it's crucial to consider various factors:

- Interest Rates: Rising interest rates can impact financing costs and investment returns.

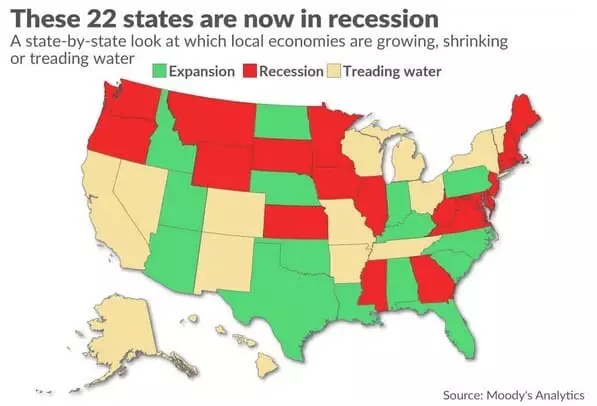

- Economic Conditions: The overall health of the economy and potential for recession should be factored in.

- Local Regulations: Portland has specific land use and zoning regulations that can influence development and investment.

- Sustainability: Environmental sustainability is a major focus in Portland, impacting building design and operations.

Conclusion

Portland's commercial real estate market is dynamic and complex, offering both challenges and opportunities. By staying informed about market trends, conducting thorough due diligence, and considering the factors mentioned above, investors and businesses can position themselves for success in this thriving city.

Categories

Recent Posts